Phuket Investor: Insure your stock holdings

PHUKET: Some readers of the Phuket Gazette who have stock market investments may feel I ignore them, because of a personal bias against equity investments right now.

For those of you who feel you have a knack for choosing good companies, or would like to participate in any upside in the broad markets, but would like to limit your exposure, one way to hedge against the downside risk that comes along with such an investment is to use “put” options.

I like to think of options, when used this way, as an insurance policy for stocks but you can get them on other financial assets as well. The cost of purchasing an option becomes almost a sunk cost, although you could sell the option and recover some of its original purchase price if your stocks go way up in value.

Just like an insurance policy, you hope you never have to “make a claim”, or make a gain from the option, as this would mean your stock market holdings lose their value. Ideally, your share prices sky rocket and you forget about the options while sipping fruity drinks on your yacht.

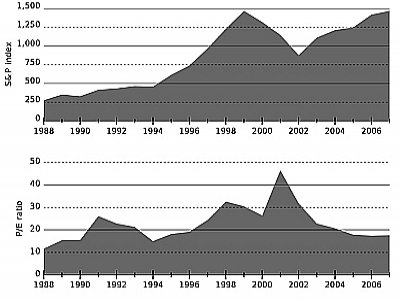

The way to hedge with options is to match the contract amounts to the number of shares you hold for a specific stock, or if you hold a diversified portfolio you can use a broad index such as the S&P 500 or FTSE 100 and match the value. The second option will not give a perfect 1:1 hedge but will do a pretty good job.

The next thing to do is determine what “level of insurance” to get.

Put options are available, which give you the right, but not the obligation, to sell at various prices. An “in the money” put option is one where the current price is below the “strike” price, or the price that it allows you to sell at.

An “out of the money” put option is one where the strike price is currently lower than the market price, and thus you could make more money by selling in the market.

Obviously the lower the strike price the cheaper it is to buy the option, so there is a tradeoff between how much money you are paying to insure the price and how much you pay for the option.

Another thing to keep in mind is that options have expiration dates, and the further away you are from their expiration, the more expensive they are. As the old saying goes, ‘there is no such thing as a free lunch’.

A very practical strategy is to purchase options which lock-in an “acceptable loss”, one where you keep the bulk of your capital in the event of a crash.

You can usually buy options online with a discount broker, and it needn’t be the same broker you use for your other investments.

David Mayes MBA lives in Phuket and provides wealth management services to expats around the globe. He can be reached at 085-335-8573 or david.m@faramond.com.

— David Mayes

Join the conversation and have your say on Thailand news published on The Thaiger.

Thaiger Talk is our new Thaiger Community where you can join the discussion on everything happening in Thailand right now.

Please note that articles are not posted to the forum instantly and can take up to 20 min before being visible. Click for more information and the Thaiger Talk Guidelines.

Leave a Reply

You must be logged in to post a comment.